China’s lithium-ion battery supply chain is experiencing emerging cost pressures, as major separator manufacturers have proposed new price increases, which could affect electric vehicle (EV) battery costs in the coming months.

Several leading separator firms have issued notices indicating price increases of up to 30 per cent for wet-process separator products. According to NBD (Daily Economic News, China), a leading separator company announced that its wet-process separator products will see a 30 per cent price increase.

Shanghai Securities Journal also reported that wet-process separator products, including base film and coated film, are expected to experience price increases of up to 30 per cent. Some firms indicate that the adjustment has begun for select customers, while the full magnitude and market-wide implementation are not yet finalised.

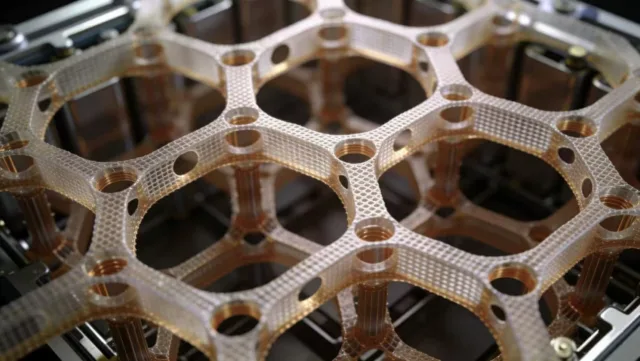

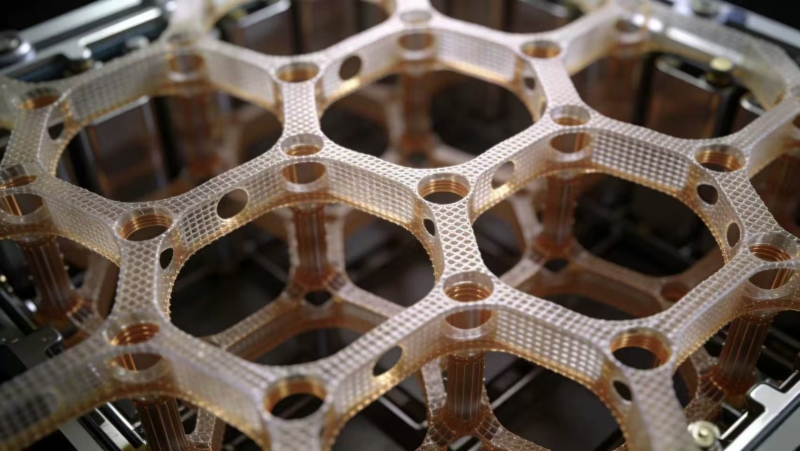

Separators are critical in lithium-ion batteries, physically isolating the anode and cathode while allowing lithium ions to move freely. They account for roughly 10–15 per cent of the cost of a cell, meaning that a 30 per cent price increase could translate into a 3–5 per cent rise in battery cell costs if entirely passed on to battery manufacturers. EVs using wet-process separators, typically higher-energy-density models, are likely to experience the most significant cost impacts.

Industry consolidation is also influencing pricing. A major manufacturer recently completed an acquisition to strengthen production of 5-micron separators and associated equipment. As reported by BatteryNet, the wet-process separator segment has maintained high capacity utilisation, suggesting stable or rising prices amid strengthened demand. Tighter market control by leading firms could constrain the supply flexibility of smaller battery producers.

Other battery materials have remained relatively stable. Lithium iron phosphate and nickel-cobalt-lithium ternary cathode materials showed minimal price changes. Lithium carbonate prices declined slightly to 90,000–93,000 yuan per tonne (approximately 12,700–13,100 USD per tonne). Anode materials maintained full output despite high petroleum coke prices, and electrolyte prices edged up amid cost pressures in six-fluorine precursor chemicals.

Analysts indicate that EV battery prices could experience moderate upward pressure in the coming months. Some cost increases may be absorbed by manufacturers or OEMs in the short term, but sustained higher separator prices could gradually influence EV battery costs, especially for models with high-energy-density cells.

Follow us for ev updates