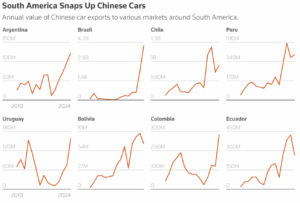

According to Invezz, Chinese companies are increasing their market share in South America, selling both combustion and electric vehicles (EVs). Chinese automakers BYD, Geely, and GWM have flooded the market with EVs that cost about 60% of a Tesla vehicle. According to the national automobile association, hybrid and electric sales in Peru, for example, hit a record 7,256 units in the first nine months of the year, a 44% annual increase, despite making up just a small portion of Peru’s 135,394 new car sales. BYD, which makes EVs, plug-in hybrids, and combustion engine cars, plans to open a fourth dealership in Lima by the end of this year, while Chery and Geely have more than a dozen dealerships in Peru. Part of China’s success has been partnering with local importers to offer more affordable models that are tailored to regional preferences.

Invezz reports that the Chinese-built Port of Chancay, north of Lima, began operations last year under Beijing’s Belt and Road Initiative and is already reshaping trans-Pacific trade. Cosco Shipping, which operates the new deep-water port, expects roughly 19,000 Chinese-made vehicles to arrive this year, with each vessel carrying between 800 and 1,200 cars. Peruvian customs data show the flow accelerating: 3,057 vehicles landed at Chancay in July, up from 839 in January. Many of those cars are being re-exported to Chile, where Chinese brands accounted for 33% of the market in July. Peru is also sending Chinese vehicles to Ecuador and Colombia, rapidly positioning itself as a regional distribution hub for hybrid, electric, and conventional models.

According to Reuters, with a price war in China, Chinese carmakers have excess inventory that is being shipped overseas to the Middle East, Central Asia, Central America, and South America, as Chinese manufacturers are looking for new markets due to barriers to entry in the United States and greater trade restrictions in Europe. EV penetration in Latin America, including Mexico and Central America, doubled in 2024 to around 4%, and continues to grow due to government incentives and the affordability of Chinese models.

The EV market share hit 10.6% of new cars registered in Chile in September, 9.4% in Brazil in August, and 28% in Uruguay in the third quarter of the year — all record highs. In Europe, 56% of new cars registered by mid-2025 were EVs, followed by 51% in China. In Japan, the EV market share is about 2% and in the United States, it is closer to 10%.

Via Reuters, Chinese automaker BYD now leads electric-vehicle sales in Brazil, Colombia, Ecuador, and Uruguay. In Uruguay, BYD has become the country’s third-largest seller across all vehicle categories, behind Chevrolet and Hyundai. China’s overall market share there has more than doubled since 2023, reaching 22%, with BYD models starting at about $19,000. The company also entered Argentina in October, despite the country’s economic turmoil and trade restrictions.

Chinese manufacturers are deepening their footprint in Brazil, which is instituting high import tariffs to encourage local production. BYD began assembling electric cars in October at a former Ford plant in Bahia, though local media have reported poor working conditions for some employees. GWM started limited production in August at its revamped Mercedes-Benz facility and plans to export vehicles from Brazil by 2027, taking advantage of trade agreements with Mexico and Chile.

At the same time, Brazil continues to import large volumes of Chinese-made cars. Earlier this year, the world’s largest vehicle carrier arrived at the port of Itajaí with roughly 22,000 cars on board, via Reuters calculations. The port of Vitória remains Brazil’s top entry point for imported vehicles. Industry and labor groups say Chinese automakers have been exploiting Brazil’s temporarily reduced EV tariffs to boost exports rather than invest in domestic manufacturing. The government has since reinstated import duties, which began rising last year and are set to reach 35% by July 2026.

Reuters points out that, despite strong interest, EV adoption across South America still faces significant obstacles, chiefly limited charging infrastructure. Long-distance travel remains difficult, but buyers are increasingly drawn to electric models for their lower operating costs and reduced maintenance needs.

Analysis

An oversaturation of vehicles in China’s domestic automobile market is encouraging companies to look abroad for sales. The Chinese-built port of Chancay in Peru provides China with an opportunity to create an inroad in South American vehicle markets, particularly with electric vehicles. This Chinese intrusion in South American markets may make U.S. politicians worry about declining economic competitiveness in the region; however, it is important to point out the large degree to which Chinese automakers, such as BYD, are subsidized by the state. The overproduction of EVs in the Chinese market and the difficulties Chinese companies face breaking into South American markets highlight the pitfalls of the Chinese model of industrial policy.

For inquiries, please contact [email protected].