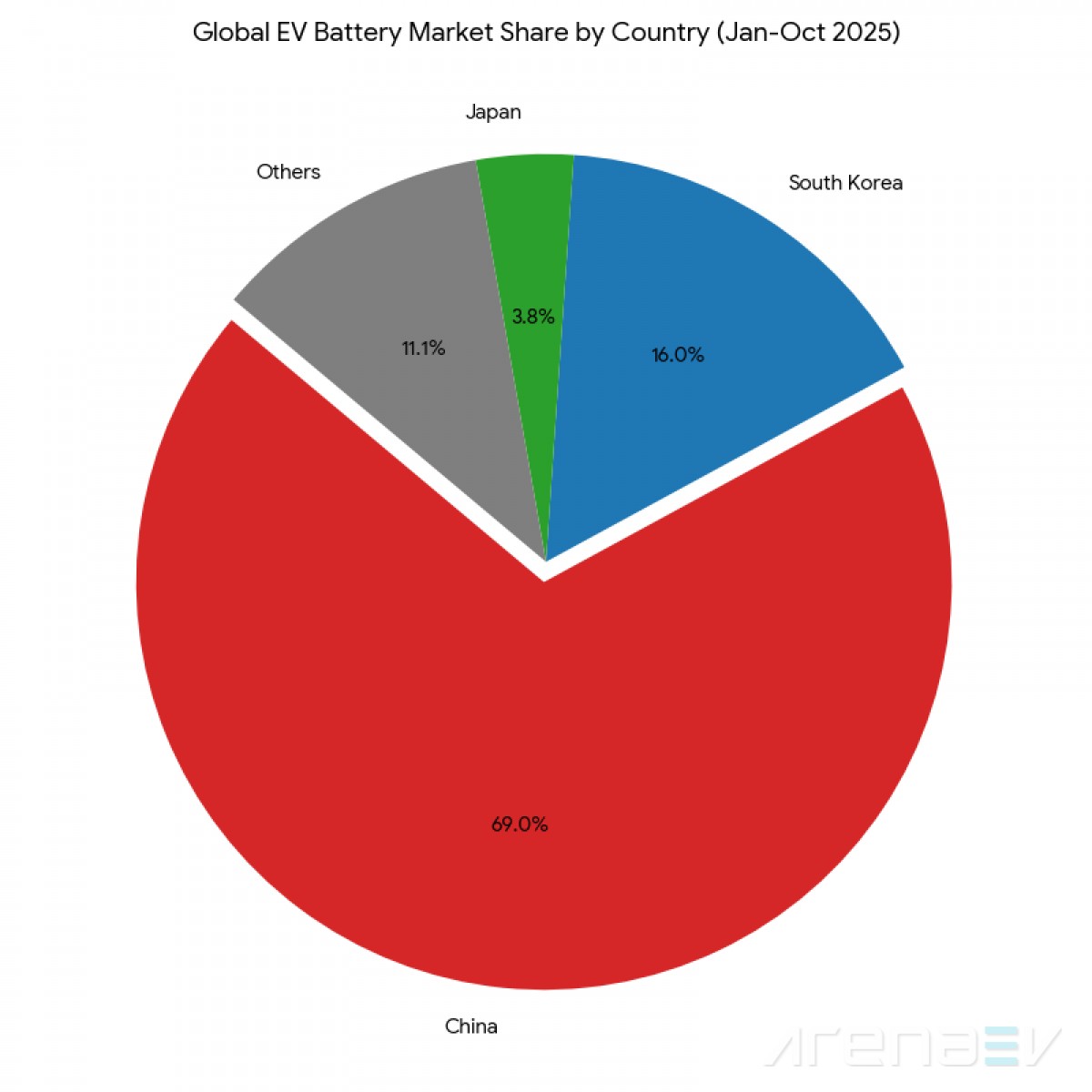

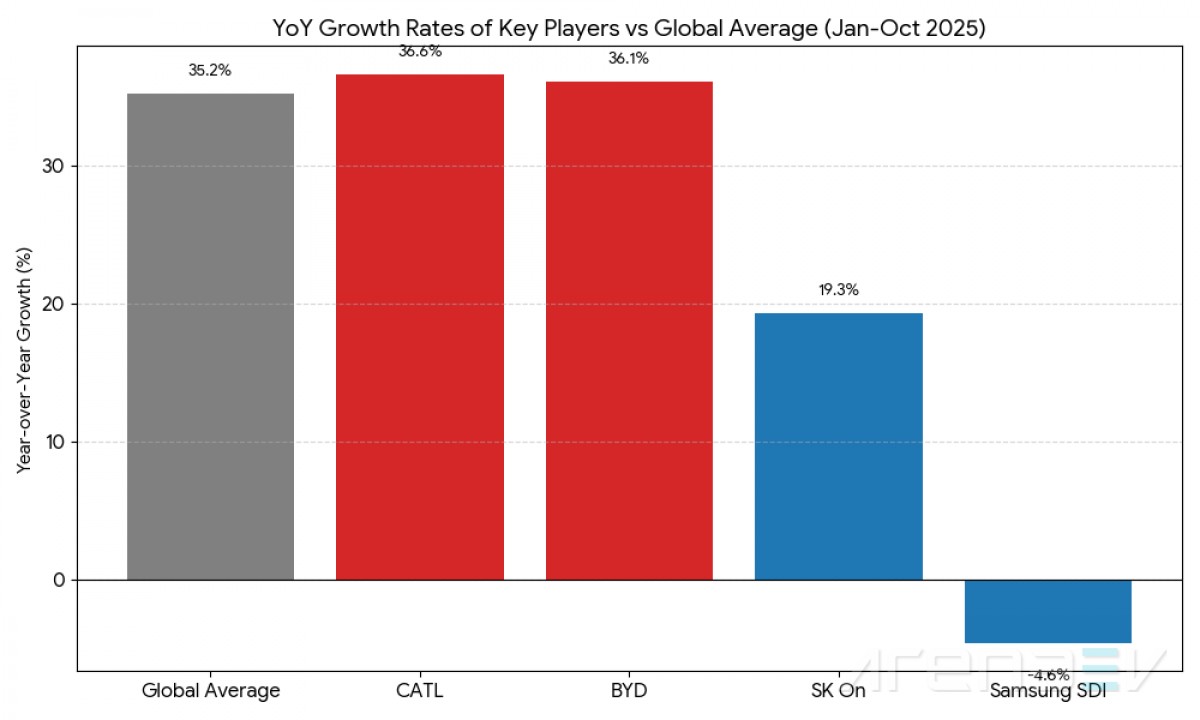

A new report from China reveals that local companies are firmly in the driver’s seat of the global race to power electric cars. During the first ten months of 2025, the world saw a big jump in the total amount of energy stored in EV batteries, reaching 933.5 GWh.

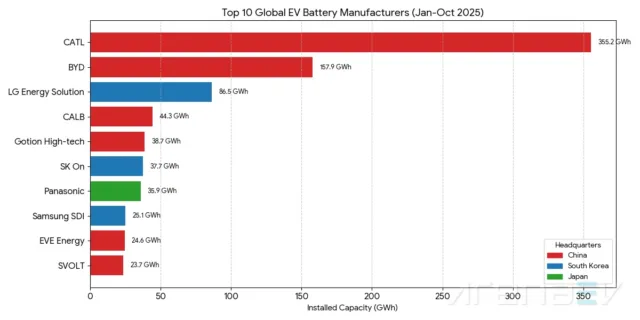

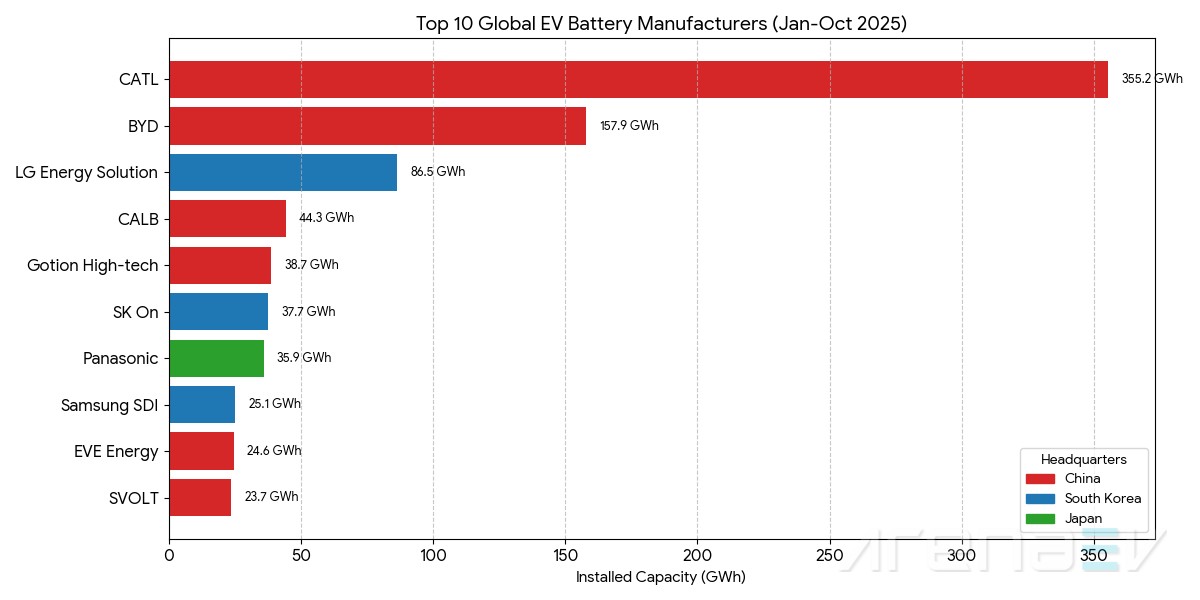

A close look at the numbers shows where all this power is coming from. Six of the top ten global battery suppliers are companies based in China. Together, these six companies control a massive 68.9% of the global market, with a combined capacity of 644.4 GWh. This is up almost 3 percentage points from the previous year. Leading the pack are the Chinese giants, CATL and BYD, who together make up over half of the entire world’s installed battery power.

CATL is the undisputed heavyweight champion, holding onto the number one spot with 355.2 GWh installed. Its market share climbed to 38.1%, which is more than double the share of its closest competitor. BYD sits comfortably in second place, installing 157.9 GWh and securing a 16.9% share. What makes BYD unique is that it builds both its own batteries and its own electric cars and plug-in hybrids. In November alone, BYD sold more than 130,000 passenger vehicles and pickups overseas, a nearly fourfold increase over the previous year.

Other Chinese companies like Gotion High-tech (38.7 GWh, 4.1% share), CALB (44.3 GWh, 4.7%), EVE Energy (24.6 GWh, 2.6%), and SVOLT (23.7 GWh, 2.5%) are also climbing the ranks.

The remaining top spots are held by South Korean and Japanese suppliers, though their combined market share has slipped slightly. LG Energy Solution is third with 86.5 GWh installed capacity. It’s a key supplier to major automakers, including Kia for models like the popular Kia EV 3 and Chevrolet for their Ultium platform EVs like the Equinox, Blazer, and Silverado. But slower sales of some Tesla models, which also use LG Energy Solution batteries, slowed its growth.

Panasonic (35.9 GWh), a major supplier for Tesla, is working hard to branch out and secure deals with other North American automakers. Meanwhile, SK On (37.7 GWh) powers vehicles like the Hyundai Ioniq 5, Kia EV 6, and various Ford and Volkswagen electric cars. Samsung SDI (25.1 GWh) supplies major electrified models for BMW, such as the i4, i5, i7, and iX, as well as Audi Q6 e-Tron.

The battle for battery supremacy is playing out on multiple fronts. CATL’s batteries are found in a wide range of popular EVs from Chinese brands like Zeekr and Xiaomi, and also in models from global players like Tesla, BMW, and Volkswagen. As the market grows, BYD is seeing huge success in Europe, where its battery usage jumped by over 216% in the first ten months of the year, thanks to its affordable and competitive vehicles.

Moving forward, the industry is focusing less on simple global expansion and more on strategic local operations. Companies are making long-term deals to secure materials and planning to build more battery production closer to where the electric cars are being assembled in North America and Europe. This shift means that battery companies must be quick to adapt to different regional rules and demands to keep their edge.

With global automakers constantly seeking better battery technology – like higher energy density and longer life – and more stable, local supply chains, the competition will only get fiercer. Keeping up with the ever-changing policies and consumer demands in different regions will be the key to leading the EV market after 2026. The shift from gas cars is fundamentally a shift in power, and right now, that power is flowing strongest from Asia.