SEOUL, Dec. 1 (Korea Bizwire) — Tesla is accelerating its push into South Korea, leveraging lower-cost China-made vehicles and a new supervised version of its Full Self-Driving system to rapidly expand its presence in one of the world’s most competitive electric-vehicle markets.

Tesla Korea sold 47,941 vehicles from January through October, up 61.1 percent from a year earlier, according to industry data released on Nov. 30. The company now holds a 25.3 percent share of the domestic EV market, trailing only Kia (28.8 percent) and Hyundai (26.5 percent).

The Model Y has become the country’s dominant EV. With 40,728 units sold in the first 10 months, it outsold Kia’s EV3 and Hyundai’s Ioniq 5 by wide margins. One in every four EVs sold in Korea this year was a Tesla, and one in five was a Model Y.

Tesla’s surge has been fueled almost entirely by imports from its Shanghai Gigafactory, which has sharply lowered prices and reduced delivery wait times. Of the 47,941 Teslas sold in Korea this year, 47,796 — or 99.7 percent — were made in China.

Nearly all Model Y and Model 3 units sold domestically originated from Shanghai, while only 145 vehicles — including 106 Model Xs, 38 Model S sedans, and a single Cybertruck — were U.S.-made.

Despite still being priced above many rivals, Tesla maintains an edge in acceleration, driver-assistance performance and software features, analysts say.

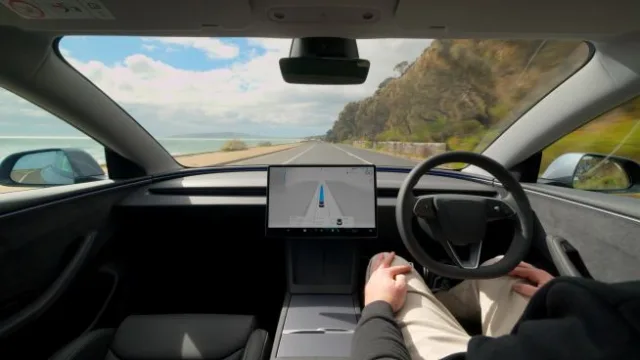

The company is also intensifying its technological push with the introduction of “Supervised FSD,” an advanced driver-assistance function now available in Korea on U.S.-built Model S and Model X vehicles.

Tesla expects to extend FSD availability to the Cybertruck later this year. Although still classified as Level 2 automation — with drivers required to maintain responsibility — FSD has drawn attention for its real-world performance. Videos showing Teslas navigating dense traffic in Seoul and Busan have gone viral on social media.

A recent U.S.–Korea tariff and trade agreement could further accelerate imports of FSD-capable models. The two countries lifted the annual 50,000-unit cap on vehicles certified under aligned safety standards, opening the door to more U.S. models entering Korea.

Tesla’s expansion is being watched closely by domestic automakers and autonomous-driving developers. Some experts see Tesla as a catalyst that could push Korea to advance regulatory reforms and accelerate self-driving R&D. Others fear Tesla could dominate an autonomous-vehicle market that has yet to fully emerge.

“In new technology markets like autonomous driving, early movers gain enormous advantages,” said Kim Kyung-yu, a senior researcher at the Korea Institute for Industrial Economics & Trade. “There is growing concern that foreign companies, including Tesla, could shape and control the domestic market.”

Kevin Lee (kevinlee@koreabizwire.com)