Tesla is reportedly telling its suppliers to remove all China-made components from parts bound for its US-based factories, a significant acceleration of its effort to decouple its US supply chain from China.

The move, first reported by the Wall Street Journal, is a fresh example of the fallout from the deepening trade and geopolitical tensions between the US and China.

According to the report, Tesla decided earlier this year to stop using China-based suppliers for cars made in the US. While the company has already replaced some components, it’s now aiming to switch all remaining parts to non-Chinese sources within the next one to two years.

This strategy isn’t entirely new. We’ve been reporting on Tesla’s efforts to diversify its supply chain since the pandemic exposed the fragility of relying on a single region. The company has been actively encouraging its Chinese suppliers to set up shop elsewhere, particularly in Mexico, to support its North American production.

However, this new push is reportedly more aggressive. The WSJ’s sources say the strategy accelerated significantly after President Trump imposed stiff new tariffs on Chinese imports, adding to the “uncertainty” that has made it difficult for Tesla to manage costs and formulate a coherent pricing strategy.

Recent disruptions, such as a spat between China and the Netherlands over automotive chips from Nexperia, have only heightened Tesla’s urgency to build a more stable, independent supply chain.

This move solidifies a strategy Tesla has been forced into: running two entirely separate supply chains.

Giga Shanghai, which produces cars for China, Europe, and most of Asia, relies heavily on a localized network of over 400 Chinese suppliers. This has been a massive success, cutting costs and enabling huge production scale.

But those cars and parts don’t go to the US. Tesla’s US factories in Fremont and Texas, which serve its biggest market, are now being firewalled from that Chinese supply base – resulting in a lack of synergy between its supply chain and its factories.

This is the latest example of the “decoupling” between the world’s two largest economies, forcing global companies to effectively pick a side for any given market.

Electrek’s Take

This will be incredibly difficult. China dominates the production of many auto parts, materials, and, most importantly, batteries. More specifically, lithium-iron phosphate (LFP) batteries.

Tesla was using these cheaper, Chinese-made LFP cells in its standard-range US-market vehicles until last year.

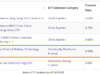

Tesla stopped this practice after the cells became ineligible for US EV tax credits under the Inflation Reduction Act (IRA) and were also hit by tariffs, but LFP cells are still Tesla’s biggest import from China for its energy storage products.

This new report confirms Tesla is all-in on building a non-China alternative. As CFO Vaibhav Taneja said in April, the company is “securing additional supply chain from non-China-based suppliers,” though he admitted, “it will take time.”

Tesla is already working on its own LFP battery production in the US, with a facility in Nevada (reportedly for its energy-storage products first) expected to come online in 2026.

But it will be a relatively low-volume plant that will help, but it won’t satisfy Tesla’s whole demand for LFP cells.