Jim Farley says competitive analysis forced him to completely overhaul the automaker’s electric vehicle strategy

Ford’s Chief Executive Jim Farley experienced a professional wake-up call that fundamentally altered his vision for the automaker’s future. After directing engineers to disassemble Tesla vehicles and electric cars from Chinese manufacturers, Farley realized the competitive gap was far wider than Ford’s internal assessments had indicated. The humbling discovery prompted sweeping organizational changes and a renewed commitment to electric vehicle development that the CEO believes will determine Ford’s survival as a global automaker.

Speaking on an upcoming episode of Office Hours: Business Edition, Farley described the moment his team began examining the internal architecture of a Tesla Model 3. The detailed analysis revealed engineering approaches and manufacturing efficiencies that starkly contrasted with Ford’s own EV designs. When the teardown process extended to vehicles from Chinese manufacturers, the findings proved even more eye-opening, demonstrating how aggressively companies like BYD had advanced their electric vehicle capabilities.

The engineering revelation

The technical comparison yielded concrete evidence of the efficiency gap between Ford’s electric offerings and competitive models. Ford’s Mustang Mach-E, the company’s flagship electric SUV, required approximately 1.6 kilometers more electrical wiring than Tesla’s Model 3. That extra wiring contributed additional weight to the vehicle, which in turn necessitated a larger and significantly more expensive battery pack to maintain comparable range and performance. The difference represented not merely a stylistic choice but a fundamental inefficiency that undermined Ford’s cost competitiveness and manufacturing profitability.

This type of competitive teardown analysis represents standard industry practice, with automotive engineers regularly acquiring and disassembling competitor vehicles to study design choices and manufacturing techniques. Even smartphone manufacturers entering the EV space have adopted this approach, with Xiaomi’s leadership revealing earlier this year that the company purchased three Tesla Model Y vehicles and systematically analyzed every component to understand Tesla’s engineering philosophy.

Organizational transformation

Farley, who assumed the CEO position in 2020, responded to the competitive reality by fundamentally restructuring Ford’s electric vehicle operations. In 2022, he created a separate division called Model E, dedicating distinct organizational resources to electric vehicle development and insulating EV operations from the company’s traditional internal combustion engine business. This structural separation allowed the EV division to operate with different metrics, timelines and accountability measures compared to Ford’s legacy automotive operations.

The Model E division has faced significant financial headwinds since its creation. The unit lost more than $5 billion during 2024 and faces projections for similar losses during the current year. Despite these substantial losses, Farley has consistently defended the decision to establish separate EV operations, arguing that public accountability to investors drives faster problem-solving and innovation. He views the losses as temporary costs associated with building competitive capabilities that will ultimately ensure Ford’s long-term viability.

Confronting hard truths

Farley’s management philosophy centers on identifying the most difficult challenges and attacking them aggressively, even when doing so creates public visibility and temporary financial pain. He acknowledged on the podcast that establishing Model E would prove brutal from a business perspective in the near term, but he believed the structural separation was essential for forcing the organization to develop breakthrough EV capabilities rather than allowing legacy automotive operations to gradually absorb EV budgets and resources.

The Ford CEO has been unusually candid about the competitive threat posed by Chinese automakers and their rapidly advancing electric vehicle technologies. In June, Farley publicly declared Chinese EVs far superior to comparable Western models, and more recently he characterized Chinese brands like BYD as completely dominating the global EV landscape. These statements have helped reshape investor and industry perception of the competitive environment surrounding electric vehicles.

The China factor

China’s electric vehicle market demonstrates the scale and speed of transformation underway globally. Approximately 50 percent of all new vehicle sales in China now represent electric models, compared to roughly 10 percent of the U.S. market. Chinese automakers have achieved this market penetration by offering diverse high-tech electric models at accessible price points, creating a virtuous cycle of scale, innovation and cost reduction that Western manufacturers have struggled to match.

Chinese EV manufacturers are expanding aggressively beyond their home market, rapidly acquiring market share in Europe and developing nations. This international expansion threatens Ford’s global competitive position, particularly in markets where price-conscious consumers prioritize affordability alongside technology and performance. Farley emphasized that if Ford abandons electric vehicles to Chinese competitors, the company surrenders not merely current market share but its long-term viability as a global automotive manufacturer.

Personal conviction through experience

Farley’s conviction about the inevitability of electric vehicle dominance extends to his personal vehicle choices. Last year, the Ford CEO revealed that he had been driving an electric sedan manufactured by Xiaomi for six months and expressed genuine reluctance to return to conventional vehicles. His willingness to experience Chinese EV technology firsthand demonstrates his belief that Western automakers must understand and eventually surpass competitive offerings rather than dismissing them.

Recalibrating U.S. strategy

Despite the existential importance Farley assigns to electric vehicles, he acknowledges that the U.S. market presents distinct challenges compared to China’s wholesale transition to battery-powered transportation. Ford reported record electric vehicle sales during the third quarter, driven partly by consumer urgency to purchase vehicles before federal tax credit programs expired. However, Farley cautioned investors that near-term EV adoption in the U.S. market will remain limited to approximately 5 percent of total vehicle sales as demand moderates following the tax credit deadline.

The disconnect between Ford’s premium EV offerings and actual U.S. consumer preferences has prompted another strategic shift. Ford discovered that American consumers prioritize affordable electric models over luxury vehicles priced at $70,000 to $80,000. This market insight contradicted Ford’s earlier assumptions about consumer willingness to pay premium prices for electric capability and performance.

The affordable EV path forward

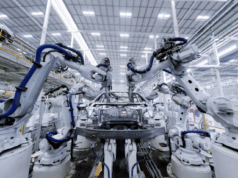

In response to this market reality, Farley unveiled a retooled production line in August specifically designed to manufacture competitive, affordable electric vehicles. The first model to launch from this new manufacturing approach will be a midsize electric truck priced at approximately $30,000, scheduled for introduction in 2027. The strategy represents Ford’s attempt to build competitive capability against BYD and Tesla by focusing on the price-sensitive market segment that represents the most significant near-term opportunity in the U.S. electric vehicle market.

Story credit: BUSINESS INSIDER