Internationally, e-mobility has been experiencing a considerable upswing so far this year. This is shown by the latest ‘Electromobility Report’ from the Centre of Automotive Management (CAM) in Bergisch Gladbach, Germany. In the world regions most important to the automotive industry, namely China, Europe and the USA, approximately 12.8 million highly electrified vehicles were sold between the beginning of January and the end of September. In addition to battery-electric cars, this also includes plug-in hybrids. This represents growth of around 30 per cent compared to the same period last year.

NEVs dominate in China

This development continues to be driven primarily by the Chinese market. In the first three quarters, a total of 8.89 million so-called NEVs, short for New Energy Vehicles, were registered in the People’s Republic. This category includes pure electric vehicles, but also electric vehicles with range extenders and cars with plug-in hybrid drives. BEVs clearly dominate with 5.45 million units. In second place, with 3.44 million units, are plug-in hybrids, which also include REEVs (Range Extended Electric Vehicles).

Overall, NEVs achieved a market share of 52.4 per cent during this period, compared to 45.3 per cent in the first three quarters of last year. The development of pure electric cars is particularly encouraging, with growth of 32 per cent and a market share of 32.1 per cent, separate from plug-in hybrids. In the same period last year, the figure was 26.2 per cent. Externally chargeable hybrids, on the other hand, are growing at a much slower pace, with an increase of only 14 per cent.

Pure BEVs are therefore playing an increasingly dominant role in China. In addition, most of these are already being produced by domestic manufacturers. The government’s decision to remove electric cars from the list of strategic industries and thus no longer promote them as strongly therefore makes perfect sense.

A certain degree of consolidation can already be observed in the local market: 70 per cent of new registrations are accounted for by the ten best-selling car companies – led by BYD with a market share of 14.2 per cent. In contrast, 93 of the 169 car manufacturers active in China have a market share of less than 0.1 per cent, which means they are likely to sink into insignificance in the long term.

Although the Volkswagen Group still ranks second in terms of total sales in China, the German automaker’s electric models are not particularly popular in the Middle Kingdom. While battery-electric drives are clearly on the rise, the Wolfsburg-based company, including the Group brands available in China, has seen a 51.3 per cent decline in NEV registrations. While BYD has a market share of 28.7 per cent in this category and Geely has 12.3 per cent, the former number one in China is far behind with 0.9 per cent.

Europe remains the second most important market

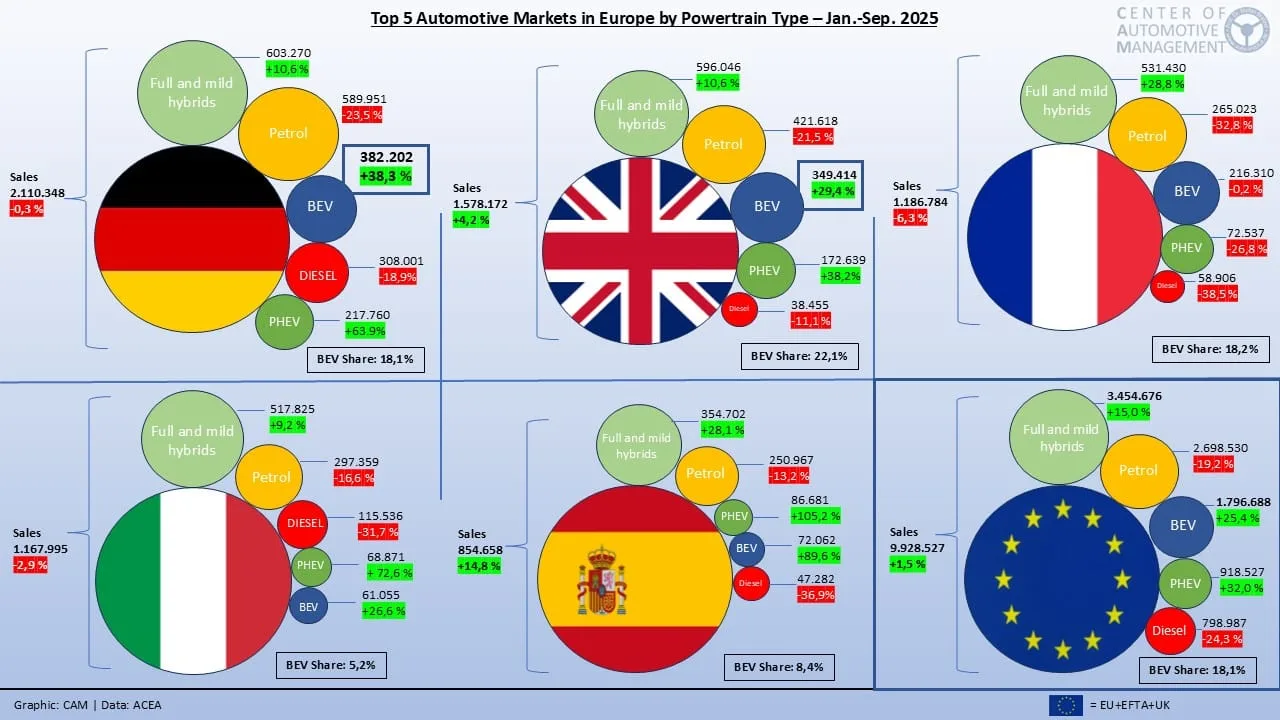

While the overall market in Europe is stagnating, strong growth in electrification is also evident here. In the first nine months of this year, 2.72 million highly electrified passenger cars were newly registered across all countries. Compared to the first quarter of 2024, this represents an increase of 27.7 per cent. The market share of pure electric cars and plug-in hybrids is 27.4 per cent. This means that Europe remains the second-largest market for BEVs and PHEVs after China.

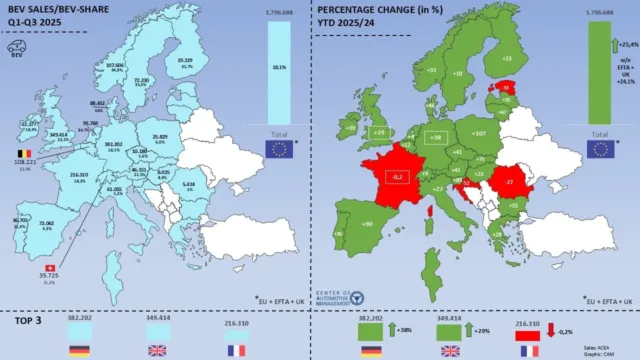

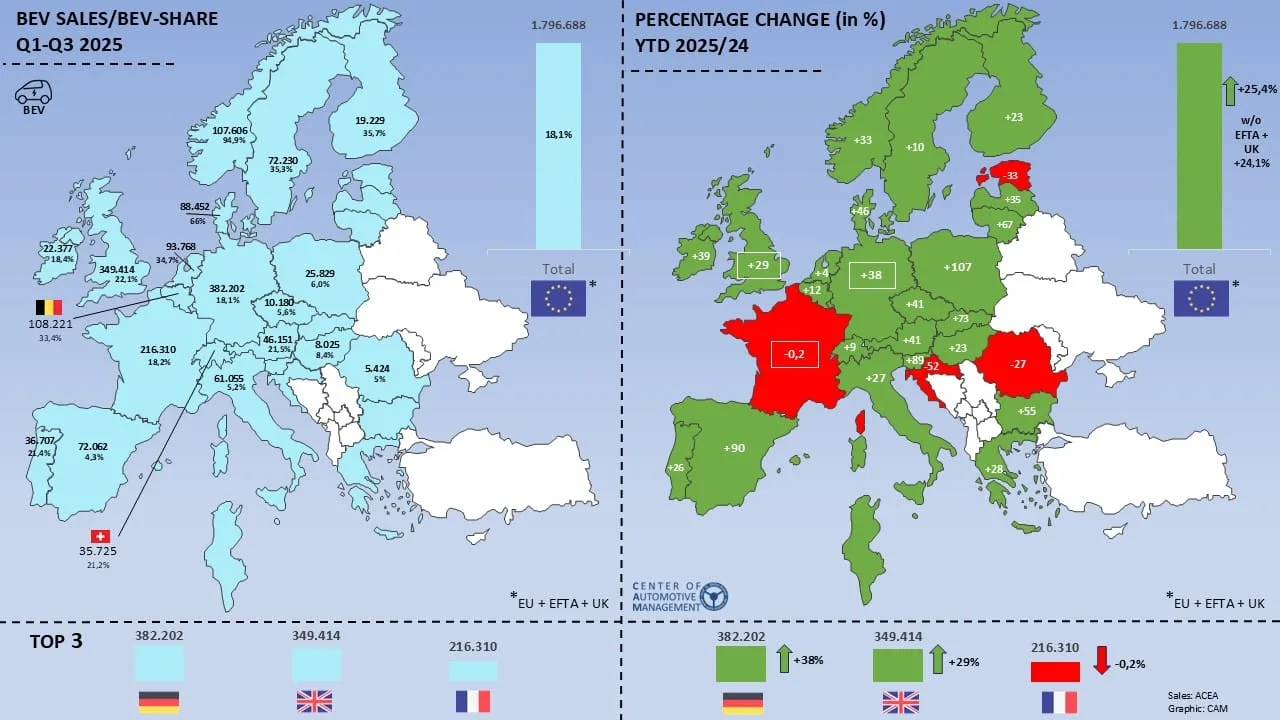

Even if plug-in hybrids are excluded, the picture for e-mobility in Europe is encouraging. Vehicles with purely electric drives recorded growth of 24 per cent in the first three quarters of the year. However, BEV sales are anything but evenly distributed across the continent. While battery electric vehicles account for very high shares well above the 30 per cent mark in the Scandinavian countries, and this type of drive is already well established in Central and Western Europe, it still has a niche existence in other regions such as Eastern Europe and the Balkans.

The three largest European markets also present a far from homogeneous picture. In France, new EV registrations fell by nine per cent from 316,000 last year to 289,000. However, this is mainly due to the declining popularity of plug-in hybrids, with sales of purely electric vehicles remaining stable at 216,000. The BEV market share is 24 per cent, down from 25 per cent in the first few months of 2024. One of the reasons for the slowdown is that the French government has tightened the criteria for subsidies.

In the UK, on the other hand, e-mobility is on the rise. A total of around 522,000 BEVs and PHEVs were registered, representing an increase of around 32 per cent over the previous year. The market share of highly electrified vehicles thus rose from 26 to 33 per cent. Pure electric cars account for the lion’s share of this, with 349,414 units. In 2024, only 269,931 new electric cars were registered on the island in the first nine months. This growth is mainly driven by a significantly expanded range of models, lower prices and various government and municipal support measures relating to charging infrastructure and vehicle fleets.

After a weak 2024, e-mobility is achieving the strongest growth of the three countries in Germany this year. A total of 600,000 electric cars and plug-in hybrids were registered – an increase of 46.6 per cent. The market share of the two electrified drive types is 28 per cent, compared to 19 per cent in the same period last year. Pure BEVs accounted for 382,000 units. CAM attributes the positive figures on the domestic market primarily to manufacturers’ electric model offensives, shorter delivery times and increasing acceptance of this drive type in company fleets.

“In Europe, despite strong growth in 2025, the ramp-up of electric mobility is in a critical transition phase with uneven development. The current discussion surrounding the increasingly ideological debate about a possible softening of the so-called ‘2035 combustion engine ban’ is causing considerable uncertainty among consumers and is hampering the rapid market ramp-up necessary for scaling,” summarised Stefan Bratzel, founder and director of CAM.

The US market is developing much more slowly

The renaissance of the electric car was kicked off by Tesla in the US, but compared to Europe and China, growth there has been modest this year. New registrations of electric cars and plug-in hybrids rose by only eight per cent to 1.22 million vehicles between the beginning of January and the end of September. This put the market share at 10 per cent in the first three quarters. In the same period last year, it was 9.7 per cent. For purely electric vehicles, it rose from 8.0 to 8.2 per cent.

After the tax credits for electric cars expired on 1 October, there was another rush for battery-powered vehicles in September. A decline is expected in the fourth quarter due to the significantly worsened market conditions under the Trump administration.

Geely posts 90 per cent BEV growth

Not only in China itself, but also globally, the BEV market is shifting in favour of Chinese manufacturers. BYD had already overtaken Tesla as the world’s largest electric car manufacturer. In the first three quarters, the group increased its deliveries by 37 per cent to 1.61 million vehicles. The share of BEVs in total sales grew from 43 to 56 per cent. Geely even increased by almost 90 per cent to 943,000 BEVs. Tesla, on the other hand, lost ground slightly, with deliveries falling by 5.9 per cent to 1.22 million vehicles.

While things are going downhill in China, the outlook for German carmakers is somewhat better globally. The Volkswagen Group increased its worldwide electric car sales by 42 per cent to 717,500 vehicles, mainly due to high popularity in the European market. BMW’s BEV business grew moderately by 10 per cent to 323,000 cars, while Mercedes-Benz remained slightly below the previous year’s level with 118,000 units, representing a one per cent decline. The Stuttgart-based company’s market share declined modestly to 8 per cent.

Source: Info via email

This article was first published by Elias Holdenried for electrive’s German edition.