Advertisement

Tesla’s China-made EV sales declined in October following a modest gain in September.

Tesla’s (TSLA) China-made electric vehicle (EV) sales declined 9.9% year-over-year to 61,497 units in October and plunged 32.3% compared to the previous month, according to data from the China Passenger Car Association (CPCA). The decline in October sales reversed the modest gain in the Elon Musk-led EV company’s China shipments in September. TSLA stock was down 2.5% in pre-market trading, on the disappointing sales update and news that another major shareholder, Norway’s Norges Bank Investment Management, has opposed Musk’s $1 trillion pay package.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla’s October China-Made EV Sales Slump

The 9.9% year-over-year decline in Tesla’s October China-made EV sales reversed the 2.8% rise in September. The EV giant manufactures Model 3 and Model Y vehicles at its Shanghai gigafactory for the domestic market and exports to Europe, India, and other markets. The October figure indicates that the launch of Model Y L, which began deliveries in China in early September, failed to boost demand.

The update also raises concerns about a challenging fourth quarter for Tesla. It is worth noting that Tesla’s China-made EV sales have declined in eight out of the first ten months of 2025 on a year-to-year basis.

Tesla’s Chinese rival BYD (BYDDF) also had a tough month, with October deliveries falling 12% year-over-year and marking the second consecutive month of decline amid stiff competition in the domestic market. Likewise, Li Auto (LI) reported a significant 38.3% plunge in its October deliveries. In contrast, Nio (NIO) and XPeng (XPEV) reported a year-over-year rise of 92.6% and 76%, respectively, in October deliveries.

Meanwhile, Tesla is set to unveil its Cybercab robotaxi at the China International Import Expo (CIIE), marking the Asia-Pacific debut of the EV maker’s driverless model.

Is Tesla a Good Stock to Buy?

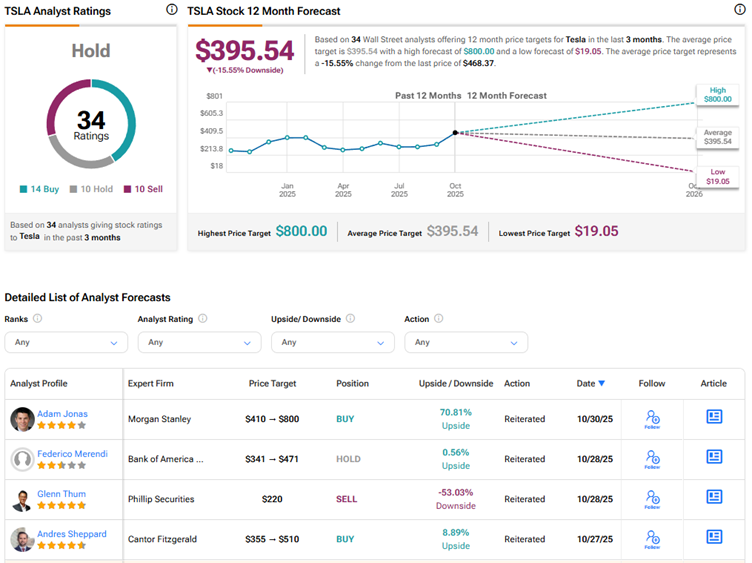

Tesla is facing demand uncertainty in the U.S. market following the expiration of the $7,500 EV tax credit and intense competition in China and Europe. Amid a challenging EV backdrop, Wall Street has a Hold consensus rating on Tesla stock based on 14 Buys, 10 Holds, and 10 Sell recommendations.

The average TSLA stock price target of $395.54 indicates 15.6% downside risk from current levels. TSLA stock has risen about 16% year-to-date, driven by optimism about the company’s robotaxi business and Optimus humanoid robot.

1