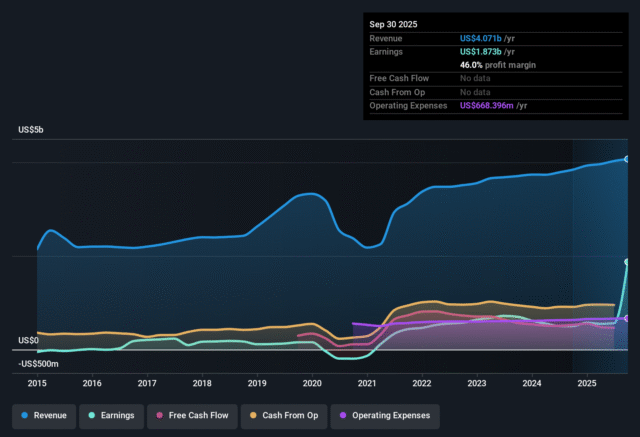

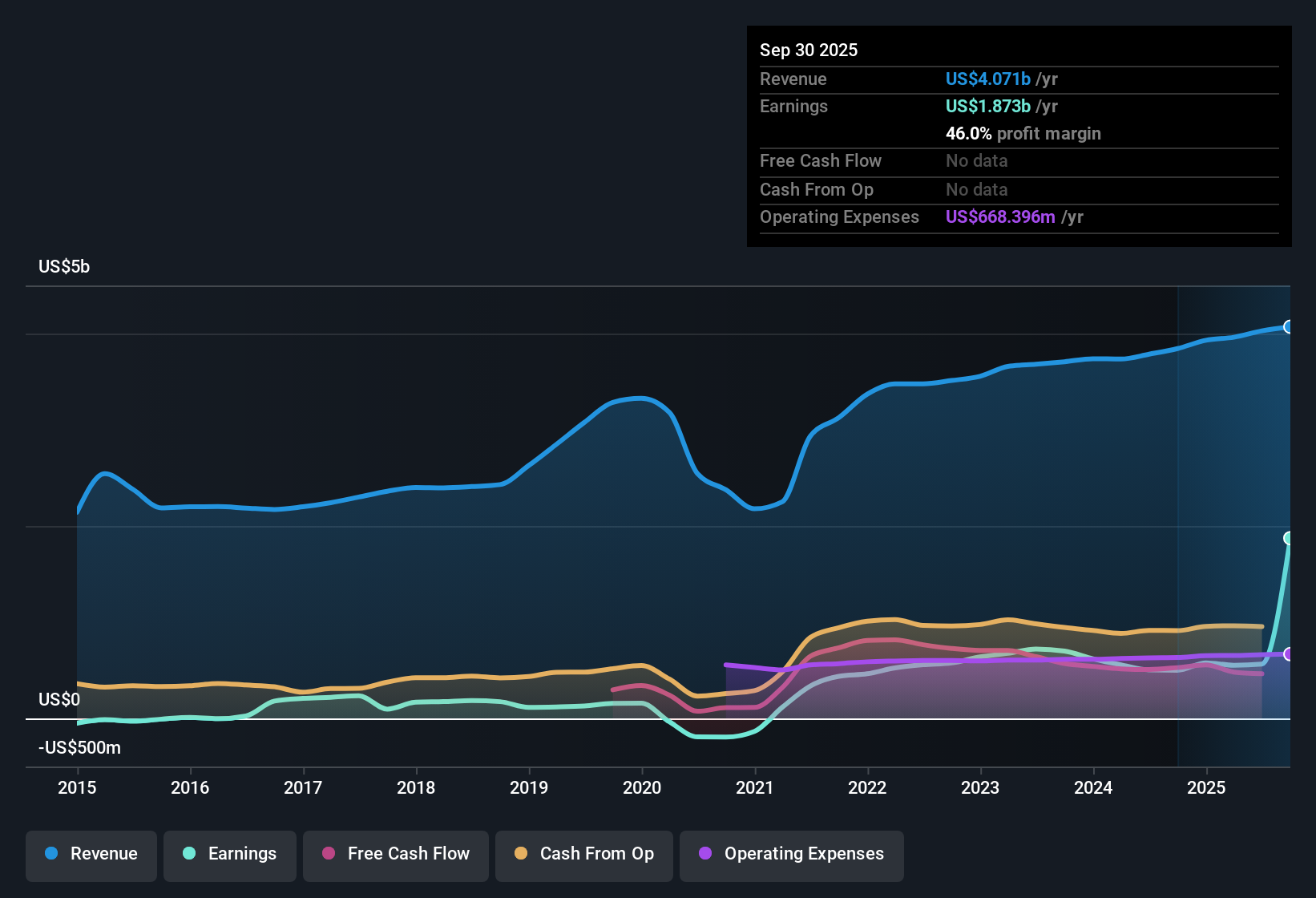

Boyd Gaming (BYD) delivered a dramatic jump in profitability this quarter, with net profit margins rising to 46% from 13% a year ago and earnings skyrocketing by 274.6% over the past twelve months compared to a 30.8% annual average over five years. This rapid expansion comes after a turnaround that saw the company transition to consistent profitability in recent years, marking a clear acceleration from its historical trend. With such a sharp improvement in earnings quality and a relatively low price-to-earnings ratio of 3.4x, investors are weighing the compelling value case against a more challenging outlook for revenue and profit in the coming years.

See our full analysis for Boyd Gaming.

The next section measures these results against the major narratives shaping market sentiment, highlighting which stories are reaffirmed and which face new questions.

See what the community is saying about Boyd Gaming

Advertisement

Expansion Projects Eye Higher Margins

- Analysts project that profit margins will rise from 14.0% now to 16.1% in three years, even as revenue shrinks by 4.7% annually in the same period.

- The analysts’ consensus view highlights several key drivers expected to boost margins, including:

- Expansion efforts such as the Sky River project and property upgrades that may strengthen gaming capacity and customer experience, helping offset anticipated top-line declines, and

- Initiatives in the Online segment and a focus on shareholder returns, which are positioned to raise EBITDAR and support premium valuation multiples despite downward revenue guidance.

- Consensus expectations hinge on Boyd’s ability to deliver steady improvements in profitability through operational upgrades while navigating near-term sales headwinds. Curious whether the latest catalysts will prove enough for sustainable value? 📊 Read the full Boyd Gaming Consensus Narrative.

Share Buybacks and Dividends Cushion Declining Sales

- Share count is forecast to fall by 7.0% per year over the next three years, signalling aggressive buybacks and an ongoing commitment to dividends even as revenue and earnings face pressure.

- According to the analysts’ consensus view, Boyd’s capital return strategy may help support earnings per share and maintain investor interest, especially as:

- Management continues regular share repurchases and dividend payments to offset earnings headwinds, and

- The company balances these efforts with the need for a strong balance sheet in response to industry competition, project costs, and economic risks that could otherwise erode shareholder value.

Valuation Discount vs. Industry and Fair Value

- Boyd trades at a P/E of 3.4x, well below the US Hospitality industry’s 23.9x average, and sits at a share price of $78.77 versus a DCF fair value estimate of $88.25 and an analyst price target of $93.08.

- The analysts’ consensus view considers this steep valuation discount an attractive entry for value-focused investors, with:

- Analysts largely agreeing that the stock is fairly priced today given current figures and forward assumptions, despite a cautious growth outlook, and

- The small gap between the current price and price target suggesting market expectations may already reflect most key risks and upcoming catalysts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Boyd Gaming on Simply Wall St. Add the company to your watchlist or portfolio so you’ll be alerted when the story evolves.

Spot something the market missed, or want to dig deeper? Share your perspective and create your own narrative in just a few minutes. Do it your way

A great starting point for your Boyd Gaming research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite impressive short-term profit gains, Boyd faces wavering revenue trends and ongoing earnings pressures that challenge its ability to deliver consistent, stable growth.

If you want more reliable performance across market cycles, discover companies delivering steadier expansion and earnings resilience by searching with stable growth stocks screener (2095 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Boyd Gaming might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com