Most major electric vehicle (EV) makers mostly saw a decrease in insurance registrations in China last week, as delivery volumes are typically lower at the beginning of the month.

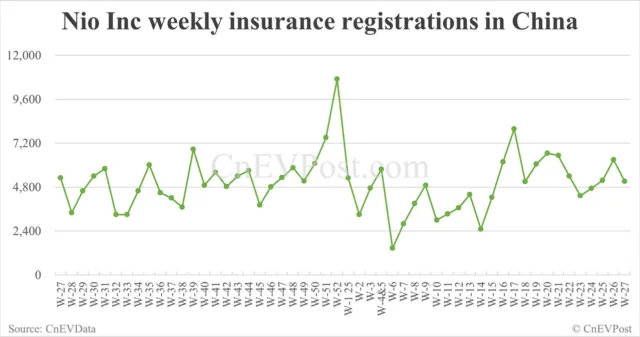

During the week of June 30 to July 6 — week 27 of 2025 — Nio (NYSE: NIO) brand vehicles in China had 2,500 insurance registrations, a decrease of 16.62 percent from the previous week’s 3,790, according to figures shared today on Weibo by several automotive industry observers.

Nio’s sub-brand Onvo saw insurance registrations of 1,310 units last week, a decrease of 21.56 percent from the previous week’s 1,670 units.

Nio’s other sub-brand Firefly saw insurance registrations of a record 1,300 units last week, an increase of 54.76 percent from the previous week’s 840 units.

Firefly’s growth last week may have been driven by the launch of the BaaS (battery as a service) option, a purchasing scheme that significantly lowers the barrier to entry for consumers looking to buy Firefly models.

Nio Inc, including the Nio, Onvo, and Firefly brands, had 5,110 insurance registrations in China last week, down 18.89 percent from 6,300 units the previous week.

Nio Inc delivered 24,925 vehicles in June, marking a new high for the year and the second highest on record. This represents a year-on-year increase of 17.52 percent and a month-on-month increase of 7.29 percent.

Onvo delivered 6,400 vehicles in June, up 1.89 percent from May. Firefly delivered 3,932 vehicles in June, up 6.85 percent from May.

Onvo will begin pre-sales of its flagship large SUV (sport utility vehicle) L90 on July 10.

Tesla (NASDAQ: TSLA) had 5,010 insurance registrations in China last week, a decrease of 75.77 percent from the previous week’s 20,680, marking the lowest figure in the past two months.

The US EV maker operates a factory in Shanghai, producing the Model 3 sedan and Model Y crossover, which are delivered to domestic customers and also serve as an export hub.

Tesla China sold 71,599 vehicles in June, including those sold in China and exported from China to overseas markets, according to data from the China Passenger Car Association (CPCA).

This represents a 0.83 percent increase from the 71,007 vehicles sold in the same period last year but a 16.12 percent increase from the 61,662 vehicles sold in May.

The delivery figures for June in China and the export figures from the Shanghai factory are currently not yet available.

Tesla made minor upgrades to the long-range versions of the Model 3 and Model Y in China on July 1, with the former seeing a price increase while the latter remained unchanged.

Xpeng (NYSE: XPEV) had 6,450 insurance registrations last week, a 42.41 percent decrease from the previous week’s 11,200 units.

The company delivered 34,611 vehicles in June, marking eight consecutive months of deliveries exceeding 30,000 units. This represents a year-on-year decrease of 224.44 percent and a month-on-month decrease of 3.24 percent.

Li Auto (NASDAQ: LI) had 7,160 insurance registrations last week, a decrease of 10.05 percent from the previous week’s 7,960 units.

It delivered 36,279 vehicles in June, a year-on-year decrease of 24.06 percent and a month-on-month decrease of 11.20 percent.

BYD (HKG: 1211, OTCMKTS: BYDDY) brand vehicles had an insurance registration volume of 55,570 units last week, a decrease of 29.27 percent from the previous week’s 78,570 units.

The company sold 382,585 new energy vehicles (NEVs) in June, the highest figure so far this year.

This represents a year-on-year increase of 11.98 percent, but only a 0.03 percent increase from May, marking the third consecutive month with a month-on-month growth rate below 1 percent, according to data compiled by CnEVPost.

Xiaomi (HKG: 1810, OTCMKTS: XIACY) had 4,890 insurance registrations last week, a decrease of 46.20 percent from the previous week’s 9,090 units.

Xiaomi’s EV unit, Xiaomi EV, delivered over 25,000 units in June, it announced last week.

On June 26, Xiaomi officially launched the YU7, its first electric SUV (sport utility vehicle), positioning it as a competitor to Tesla Model Y.

The YU7 received 200,000 firm orders within the first three minutes of sales and over 240,000 locked-in orders within 18 hours, as previously announced by Xiaomi.

On July 6, Xiaomi EV began delivering the YU7.

The Zeekr (NYSE: ZK) brand registered 3,230 vehicles last week, a decrease of 2.12 percent from the previous week’s 3,300.

Zeekr Group delivered 43,012 vehicles in June, a decrease of 7.58 percent from May’s 46,538, ending three consecutive months of sequential growth.

The Zeekr brand delivered 16,702 vehicles in June, a year-on-year decrease of 16.93 percent and a month-on-month decrease of 11.67 percent from May.

Lynk & Co delivered 26,310 vehicles in June, a year-on-year increase of 7.66 percent, but a month-on-month decrease of 4.78 percent from May.

Leapmotor (HKG: 9863) registered 9,390 vehicles for insurance last week, a decrease of 11.58 percent from the previous week’s 10,620.

It delivered 48,006 vehicles in June, marking the second consecutive month of record-high deliveries.

This represents a decrease of 138.65 percent from the 20,116 units delivered in the same period last year and a decrease of 6.52 percent from the 45,067 units delivered in May.

Aito — the brand jointly developed by Huawei and Seres Group — had 9,400 insurance registrations last week, a decrease of 19.86 percent from the 11,730 units registered the previous week.

Data table: China EV insurance registrations in Jun 30-Jul 6