BYD Company (BYDDF) (BYDDY) is gearing up to report Q1 earnings on April 25, with forecasts pointing to a massive profit surge despite global tariff pressures. The Chinese EV leader is expected to post strong numbers, but its global expansion plans are running headfirst into rising trade barriers.

BYD Q1 EPS Expected to Surpass Consensus Forecast

Here’s what’s expected: BYD’s net income could land between RMB 8.5 billion and RMB 10 billion ($1.16 billion to $1.37 billion). That would nearly double last year’s RMB 4.1 billion ($560 million). Analysts see earnings per share (EPS) coming in between RMB 2.91 and RMB 3.42 ($0.35 to $0.42), up from RMB 1.57 ($0.21) in Q1 2024.

Revenue is a different story. Analysts forecasted RMB 240 billion ($33.06 billion), but BYD’s likely coming in at around RMB 169.69 billion ($23.2 billion). That’s below estimates but still a 35.8% jump from last year.

BYD Ramps Up Global Sales but Faces 247% U.S. Tariffs

BYD is expected to report record-breaking vehicle sales for Q1, with over 1 million new energy vehicles (NEVs) sold—a 59.8% jump from the same period last year. Overseas sales doubled to more than 206,000 units, highlighting BYD’s aggressive push beyond China.

But that global success carries a hefty price. The U.S. has escalated tariffs on Chinese EV imports to an eye-watering 247.5%, combining the Biden administration’s 100% tariff from 2024 with an additional 145% introduced by the Trump administration in April 2025, plus a 2.5% import duty. According to Business Insider, that means a budget EV like BYD’s Seagull, priced at $7,800, now faces an extra $19,300 in tariffs—effectively pricing it out of the U.S. market.

Europe is also circling, with the EU investigating subsidies tied to BYD’s planned Hungary factory.

BYD Leans Into Fast Charging and Autonomy to Hold Its Edge

Technology isn’t just part of BYD’s game plan—it’s the backbone of how it plans to hold its ground in a crowded EV field. The company recently unveiled a superfast charging system that delivers 470 km of range in just five minutes. That’s the kind of headline-grabbing stat that speaks directly to EV buyers still hesitant about charging times.

Then there’s “God’s Eye”—BYD’s in-house self-driving platform. It’s being rolled out across its lineup, signaling that the company is pushing hard to match the autonomy ambitions of bigger Western names.

Still, as tariffs and global tensions chip away at Chinese EV pricing power, BYD may have no choice but to lean on tech upgrades like these just to hold its ground in key markets.

BYD Uses Share Repurchases to Signal Confidence

Ahead of its earnings release, BYD has been flexing a familiar financial muscle—buying back its own shares. It’s a move that tends to catch Wall Street’s attention. Share repurchases trim down the number of shares floating around, which in turn can give a little lift to earnings per share. It’s also a well-timed signal that leadership sees value in the stock even as tariffs and trade disputes churn in the background.

For investors, the repurchases tell a story. They suggest BYD’s management isn’t just bracing for short-term shocks—they’re confident enough in the fundamentals to buy back their own shares. But with U.S. tariffs and European probes still in play, how far that confidence can stretch is still uncertain.

Is BYDDF a Good Stock to Buy Today?

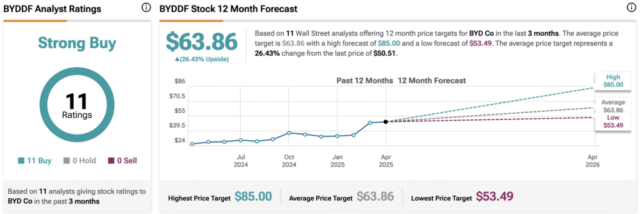

Analysts remain bullish on BYDDF stock, holding a Strong Buy consensus based on 11 unanimous Buy ratings. Over the past year, BYDDF has increased by more than 95%, and the average BYDDF price target of $63.86 implies an upside potential of 26.4% from current levels. These analyst ratings are likely to change following BYD Company’s results.