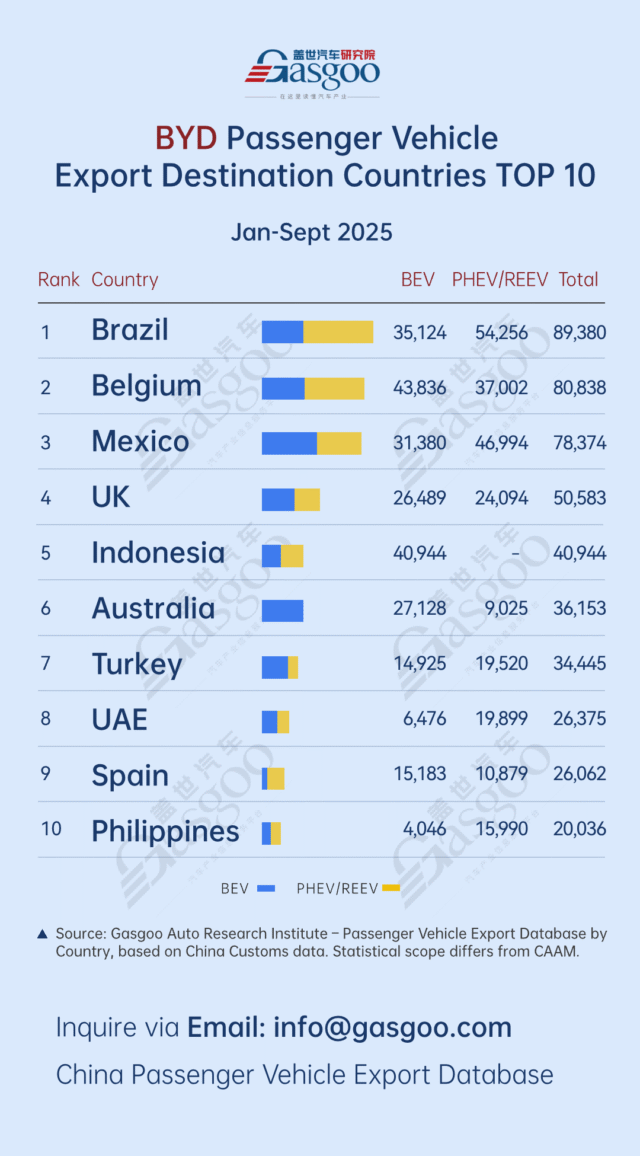

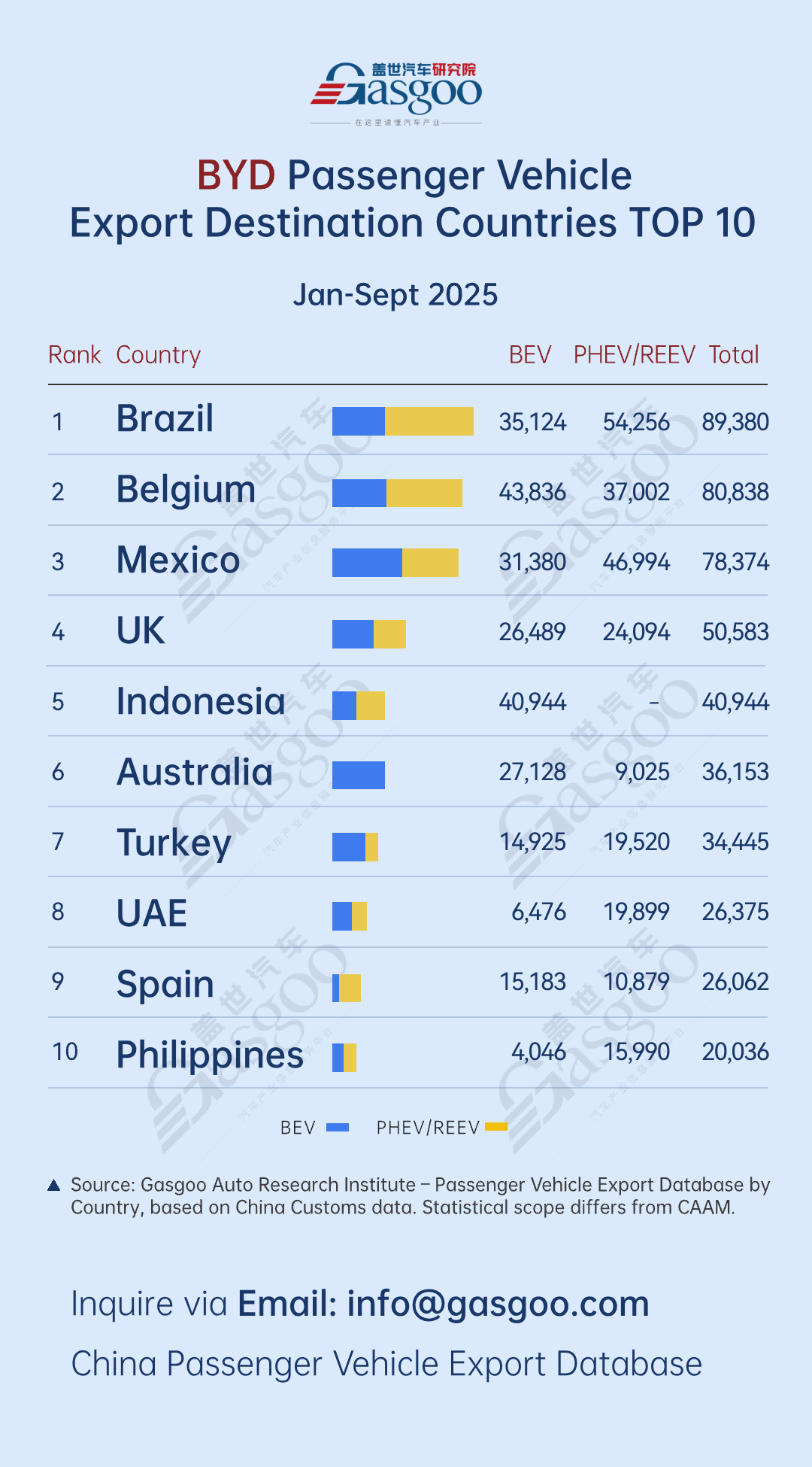

According to data compiled by the Gasgoo Automotive Research Institute, BYD’s passenger vehicle exports continued to perform strongly from January to September 2025, with its strategic focus remaining on Mexico, Brazil, Europe, and Southeast Asia. The company’s global layout shows diversified coordination, optimized structure, and differentiated demand. Latin America, as a traditional growth engine, maintained strong momentum; Europe remained stable with channel and product advantages; and Southeast Asia saw rapid growth driven by regional electrification policies. Overall, BYD’s export ecosystem has become more diversified and resilient.

Here are the top 10 destination countries by BYD passenger vehicle exports from January to September, with detailed data:

NO.1 Brazil: 35,124 battery electric passenger vehicles and 54,256 plug-in hybrid electric passenger vehicles, totaling 89,380 units.

NO.2 Belgium: 43,836 battery electric passenger vehicles and 37,002 plug-in hybrid electric passenger vehicles, totaling 80,838 units.

NO.3 Mexico: 31,380 battery electric passenger vehicles and 46,994 plug-in hybrid electric passenger vehicles, totaling 78,374 units.

NO.4 UK: 26,489 battery electric passenger vehicles and 24,094 plug-in hybrid electric passenger vehicles, totaling 50,583 units.

NO.5 Indonesia: 40,944 battery electric passenger vehicles.

NO.6 Australia: 27,128 battery electric passenger vehicles and 9,025 plug-in hybrid electric passenger vehicles, totaling 36,153 units.

NO.7 Turkey: 14,925 battery electric passenger vehicles and 19,520 plug-in hybrid electric passenger vehicles, totaling 34,445 units.

NO.8 UAE: 6,476 battery electric passenger vehicles and 19,899 plug-in hybrid electric passenger vehicles, totaling 26,375 units.

NO.9 Spain: 15,183 battery electric passenger vehicles and 10,879 plug-in hybrid electric passenger vehicles, totaling 26,062 units.

NO.10 Philippines: 4,046 battery electric passenger vehicles and 15,990 plug-in hybrid electric passenger vehicles, totaling 20,036 units.

From BYD’s passenger vehicle export rankings in January–September 2025, Latin America remained the company’s largest growth driver. Brazil topped the list with 89,380 units exported—35,124 battery electric vehicles (BEVs) and 54,256 plug-in hybrid electric vehicles (PHEVs)—further strengthening BYD’s leadership in the region’s new energy vehicle (NEV) market. Mexico ranked among the top 3 with 78,374 units (31,380 BEVs and 46,994 PHEVs), forming a dual growth engine with Brazil and underscoring BYD’s deep penetration and strong demand insight in the Latin American market.

Belgium, the United Kingdom, and Spain remained BYD’s key export strongholds in Europe. Belgium ranked second with 80,838 units, leveraging its strong port logistics and distribution capabilities to serve as a core transit hub and regional gateway for Chinese NEVs entering Europe. The United Kingdom maintained steady growth with 50,583 units, driven by supportive policies and an ongoing wave of consumer upgrades that continue to stimulate market demand. Spain entered the top 10 with 26,062 units—15,183 BEVs and 10,879 PHEVs—reflecting BYD’s balanced «BEV + PHEV» product strategy tailored to the European market.

Southeast Asian markets such as Indonesia and the Philippines held key positions on the list, each showing distinct demand patterns. Indonesia led with 40,944 BEVs, perfectly aligning with its national push for electrification and revealing strong growth potential in the NEV segment. The Philippines recorded 20,036 units in total, including 15,990 PHEVs, reflecting the segment’s adaptability to local road conditions, fuel prices, and consumer preferences. Overall, Southeast Asia’s diverse demand landscape underscores the value of BYD’s precise market positioning, which is paving the way for continued growth in the region.

The regional mix between BEV and PHEV exports highlights clear differences in market demand: European countries maintain a balanced structure, Indonesia is dominated by BEVs, while Turkey, the UAE, the Philippines, and Brazil show stronger preference for PHEVs. This divergence reflects how factors such as fuel prices, road conditions, and charging infrastructure deeply shape consumer choices. As BYD accelerates its localization of manufacturing, after-sales services, and charging networks overseas, its ability to respond to these «multi-polar demand patterns» will continue to strengthen, providing a solid foundation for sustained export growth.